#1 Rated Stock: Horizon Kinetics Inflation Beneficiaries ETF

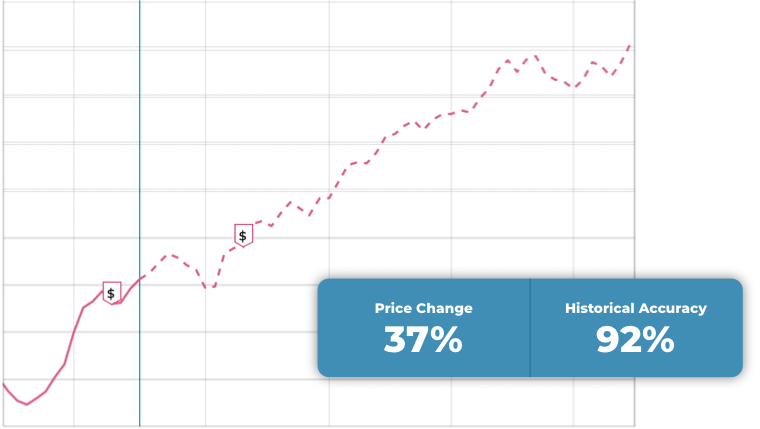

Horizon Kinetics Inflation Beneficiaries ETF has gained 12.99% since Last Buy Signal on 02/06/2026

INFL

Horizon Kinetics Inflation Beneficiaries ETF

Did You Miss Out On 12.99% Gains

In The #1 Stock This Week?

How We Calculated The #1 Stock?

The current Horizon Kinetics Inflation Beneficiaries ETF [INFL] share price is $54.12. The Score for INFL is 96, which is 92% above its historic median score of 50, and infers lower risk than normal.

INFL is currently trading in the 90-100% percentile range relative to its historical Stock Score levels.

This Score is currently showing an extreme reading that indicates risk levels may be considerably lower than normal.

Trading Simplified: Algorithmic Buy & Sell Ratings Using Stock Score

Financhill’s Stock Score Tool is designed to help you do one thing. Simplify your trading.

When it comes down to it, we’d all love to have something that answers one single question:

Is this stock a Buy, or is it a Sell?

That’s what we set out to build at Financhill.

Fast forward thousands of hours, and we built an engine that scans every stock in depth by:

- Crunching the fundamental data

- Analyzing the technical indicators of the chart

- Factoring market sentiment

Massive amounts of data is analyzed for every single stock, but the result is easy to understand: a simple Stock Score ranging from 1 to 100.

A Score above 50 is a Buy. A Score below 50 is a Sell.

Is it a Buy or is it a Sell?

Trading Simplified.

Just think about it. It would take someone weeks to build out the spreadsheets necessary to analyze the fundamentals of a single public company.

Then you’d also have to be an expert at chart technicals. Plus you’d have to spend hours a day tracking sentiment indicators. And most of that work would be for just ONE stock!

Financhill does that for EVERY stock so you don’t have to! All you have to do is tap a few keystrokes on your keyboard and press the mouse button!

Sounds amazing, right? But, does it work?

One incredible example is AAPL. At the time of writing this, if you had bought AAPL on day one and held it until now, you’d have enjoyed an amazing return of 48,295 percent.

So for every $100 invested, you’d have over $48,000. Not bad!

But if during that same period you were using Financhill’s Stock Score and you held AAPL stock only when it had a Stock Score that was a BUY…

You’d be up an astounding 1,135,124%!

For every $100 invested, you’d have gains of One Million One Hundred Thousand and One Hundred and Twenty-Four Dollars.

While that is an example with extreme gains, it’s not like we had to pick some no name stock just to cherry pick a winner. This is APPLE!

Another example is Bank of America.

Buy and hold from day 1? 258% return.

Still not bad!

Hold only when Financhill Stock Score is a BUY? 5,319%!

I could list hundreds, even thousands of examples, but I won’t waste your time. You can check them out for yourself. Or simply view your favorite stocks.

A simple way to think about Stock Score is it does for stocks what Google does for search.

When Google search came out it wasn’t just the best. It was 10x better than the competition.

Why? Google search was able to add a quality score element to their results. That ensured users saw only the highest quality results on page 1.

This is what Financhill brings to stock research. A quality score.

One that has absolutely zero human bias factored in. So now you can answer the question easily?

Is it a Buy or is it a Sell? Trading Simplified.

Ps: Buy and Sell Ratings are just the tip of the iceberg, how would you like to know what stocks have an 88% chance of rising 9% in the next 28 days?

Pps: If you’re thinking “I’ve seen just a tiny fraction of what Financhill can do and I’m already convinced this is the most powerful software to generate QUALITY TRADING IDEAS I’ve ever seen…”