Palo Alto Stock Split: Cybersecurity is a major growth trend in what is an increasingly sophisticated and technologically-driven society.

Indeed, industry revenue will hit $160 billion in 2022 and is predicted to continue expanding at a rate of 13% over the next seven years.

Such rapid growth in the sector shouldn’t come as a surprise, as more and more businesses begin migrating their operations online. In fact, the demand for cybersecurity services has never been higher, with companies desperate for help in protecting their data from hackers and other web-based criminals.

One company that’s benefited from the need for stronger digital security is cybersecurity outfit Palo Alto Networks. The business specializes in delivering automated security solutions to more than 85,000 customers, and provides a whole range of products, including its Prisma Cloud Platform and a deep learning-enabled Next-Generation Firewall.

Palo Alto made the news recently when the firm announced its first-ever stock split. The proposed action would entail a 3-for-1 share redistribution, meaning investors would receive an additional two shares for every one they held prior to the split.

The decision to go ahead with the split appears entirely logical – the firm’s shares have risen significantly in price since its initial public offering, and executing the split now would broaden the company’s potential investor base.

But what are the true implications of Palo Alto’s stock split – and does it really bode well for shareholders in the future? Let’s find out.

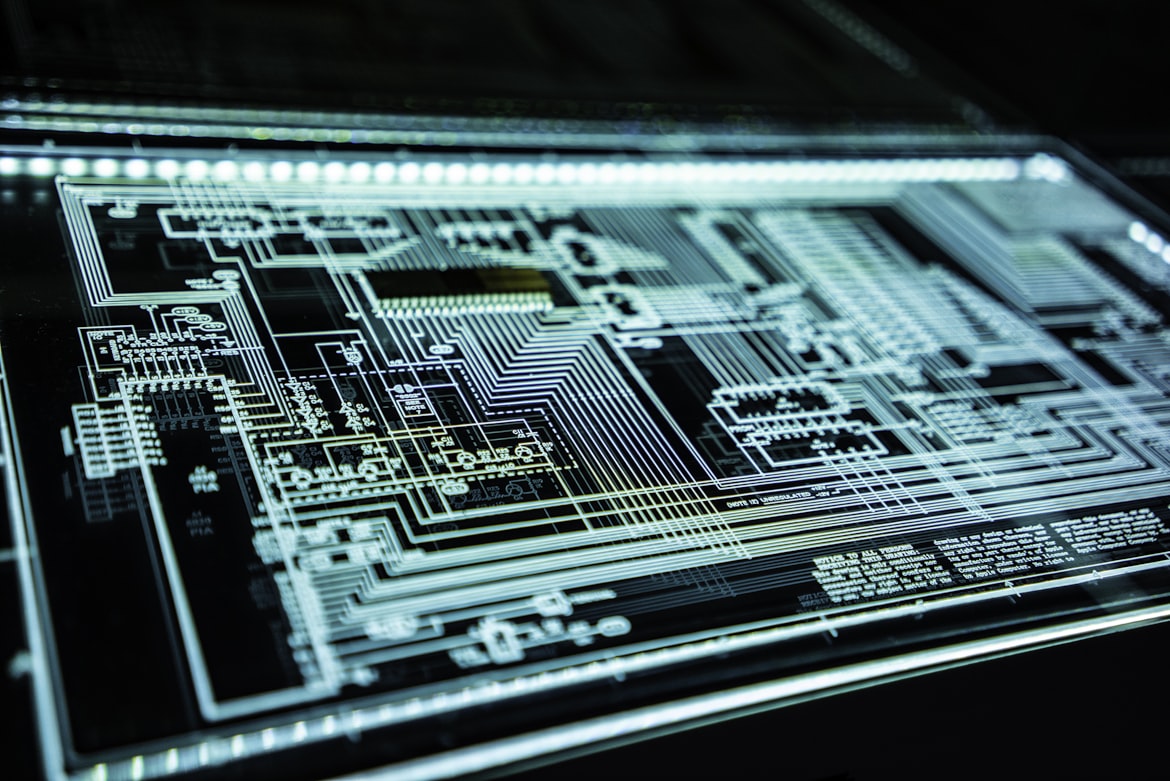

Source: Unsplash

An Excellent Quarter

Palo Alto turned in a spectacularly good fiscal fourth quarter for the period ended July 31, 2022. The company reported annual revenue growth of 27%, and became profitable on a GAAP basis for the first time in four years.

Furthermore, its total billings were up 44% at $2.69 billion, while its operating income increased 52% to $323 million.

The company also enjoyed strong momentum in its Global 2000 customer acquisition efforts, managing to grow its share from 35% in 2020 to 50% today.

Is Palo Alto’s Stock Split Good Or Bad For Investors?

Although stock splits often engender excitement and optimism in investors’ minds, they don’t actually impact the underlying fundamentals of a company. All things being equal, the value of your shares after a stock split will be worth the same as they were before.

That said, the reasons that motivate a business to initiate a stock split are usually positive in nature, and can point to improving performance for the firm.

As the last quarter attests, Palo Alto’s financial accomplishments have certainly been stellar lately. Indeed, the firm believes it can increase its sales another 20% in the year ahead, which will no doubt attract additional interest from eager investors.

Anticipating such interest may have been one of the factors behind why PANW decided to go ahead with a stock split just now. Its streamlined share price will make it more affordable and attractive for buyers to purchase the stock, in both a literal and psychological sense.

However, one potential downside of a stock split is the fact that the action can signal to investors that a company is more interested in short-term gains than long-term growth.

For instance, if Palo Alto splits its stock in order to more easily raise capital through an equity offering, the market might interpret that as a sign the firm lacks liquidity. And while the split might be good for management and shareholders in the immediate term, it could ultimately hurt the company if it leads to too much negative sentiment about the brand further down the line.

Is Palo Alto Stock A Buy?

From a valuation perspective, Palo Alto trades at a pretty steep premium today, with a forward P/E ratio of 58x. However, compared to its peers in the space, PANW is fairly cheap, given that CrowdStrike and Zscaler are both rated at 143x and 160x, respectively.

As mentioned earlier, PANW also managed to turn a profit for the quarter this year, heavily suggesting the firm is making solid headway on the earnings front. Its guidance has non-GAAP EPS coming in at between $9.40 and $9.50 for the full year 2023, which would be close to a 25% increase on the figure it generated in 2022.

Moreover, the company also has a number of growth drivers that should underpin its ability to scale up in the future. The business is becoming more valuable to its customers in the wake of the Russia-Ukraine conflict, and its cloud-based Secure Access Service Edge could bring in huge revenues, as the market for such products is expected to grow at a CAGR of 36% between now and 2025.

The demand for cybersecurity solutions is only going to increase over the coming years. Palo Alto is already a big part of the industry and looks likely to improve its standing in it too. The company has added an extra 50% more active millionaire customers to its roster, and there’s little to imply the business doesn’t have a great future – making the company a definite buy at its current price.

Palo Alto Networks Stock Split: Wrap-up

Palo Alto’s upcoming stock split is excellent news for the company. The split will increase liquidity in the stock, making the business more affordable for retail and small-scale investors.

Furthermore, as the split is a catalyst for a new influx of capital into the company, this should elevate its share price in the short term, at least.

The author has no position in any of the stocks mentioned. Financhill has a disclosure policy. This post may contain affiliate links or links from our sponsors.