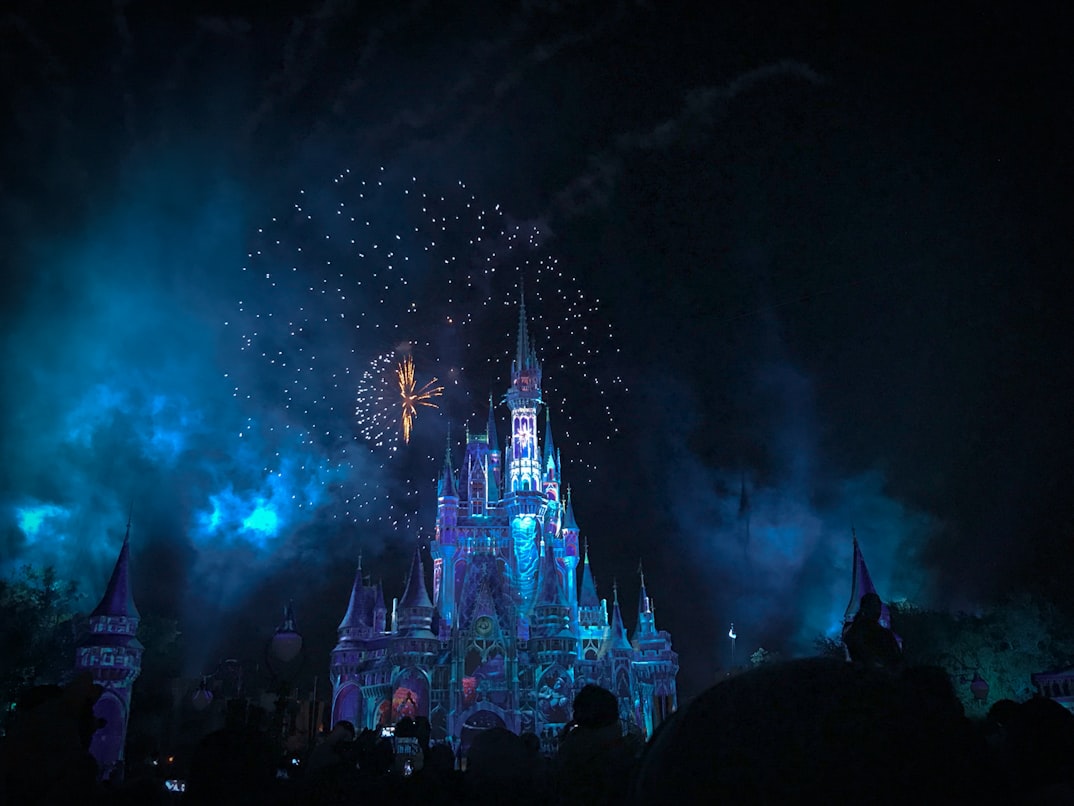

Disney

The Walt Disney Company is often seen as a magical brand that elicits feelings of happiness and nostalgia in both adults and children alike.

Indeed, one factor that contributes to this perception is the firm’s long history of producing high-quality, imaginative content.

From classic films like Snow White and the Seven Dwarfs, to modern franchises such as Star Wars and the Marvel Cinematic Universe, Disney has a knack for creating stories and characters that capture the hearts and minds of people of all ages.

However, there’s more to the company than just its ability to enchant its fans. In fact, as a business, DIS appears to be an attractive investment opportunity due to its strong economic moats, diversified revenue streams and excellent potential for growth.

For example, the company generates cash from a variety of sources, including parks, resorts, media networks and studio entertainment. This diversification helps to mitigate risk and ensures a steady stream of income, even if one particular segment should underperform.

Going forward, the business has a major growth opportunity in the streaming market, which the company entered with the launch of Disney Plus. The service has seen strong demand – it has 12.1 million subscribers after just three years of operations – and there’s also greater potential for further expansion as more people turn to the medium for their entertainment needs.

Six Flags

Six Flags Entertainment Corporation is a leading theme park company, operating 27 parks throughout the United States, Canada, and Mexico.

A key component to the firm’s present success has been its scalable business model, built as it is on a strong foundation of high-quality assets and a reliable stream of revenue.

For instance, its parks attract millions of visitors each year, providing a steady flow of recurring cash in the form of ticket sales, in-park spending, and sponsorships. In addition, Six Flags also generates significant monies from merchandise licensing and real estate operations too.

Furthermore, the company also managed to increase its admissions spending per capita by 22% in the third quarter, while seeing attendance numbers significantly accelerate “in October and early November.”

Looking ahead, Six Flags is well-positioned to capitalize on favorable trends within the sector, as the company’s strong brand and diverse portfolio of assets provide a solid foundation for long-term success. Given these factors, SIX is an attractive investment opportunity for those looking to profit from the potential growth and rebound of the American theme park industry.

Carnival

As the world’s largest cruise ship operator, Carnival Corporation & plc delivers a wide array of exciting vacation experiences to travelers from all across the globe.

With a fleet of over 100 ships spanning ten well-known brands, the company offers something for everyone. From fun-filled family vacations to romantic getaways and everything in between, CCL has a cruise vacation that’s suitable for just about anyone.

Indeed, as the leader in the cruise ship industry, Carnival is constantly innovating to bring its guests new and unique experiences. It was the first cruise line to offer onboard casinos, water parks, and rock climbing walls, and it continues to push the envelope with new offerings such as skydiving simulators and laser tag arenas.

Moreover, the business caters to a variety of passenger preferences and budgets, including luxury brands such as Seabourn and Cunard, as well as more affordable brands like Carnival Cruise Line and Princess Cruises. The company also operates Holland America Line, Costa Cruises, P&O and AIDA, while, complementary to its liners, the company also operates several tour companies and a cruise terminal business.

In addition to making waves at sea, the business has also been making waves in the financial markets too. The firm recently reported its fourth-quarter business update, announcing it had made an unprecedented $5.1 billion in total customer deposits for the period.

Unfortunately, the cruise ship sector was hit hard by the coronavirus crisis, with many companies suspending operations indefinitely in response to the pandemic. Nevertheless, Carnival is beginning to rebuild its operations and expects to see capacity growth of 3.7% for the first quarter of 2023, with occupancy 90% higher than it was at the same time in 2019.

Cinemark

Cinemark Holdings, Inc. is a major player in the worldwide movie theater industry, operating over 500 cinemas and nearly 6,000 screens in the US and beyond. However, the company’s stock has been under pressure due to the COVID-19 pandemic, which has significantly impacted movie attendance over the last few years.

That said, as the world begins to recover from the pandemic, the sector is showing signs of a recovery. Vaccine initiatives and government guidance on mask-wearing have led to a decrease in COVID-19 cases, as well as an increase in consumer confidence. This bodes well for CNK, as the company stands to benefit from the uptick in movie theater attendance.

In fact, Cinemark is likely to benefit from the rollout of big blockbuster movies such as Avatar: The Way of Water and The Little Mermaid. And as one of the largest theater chains in the world, it stands to generate significant revenue from the sale of tickets and concessions for these types of highly anticipated films.

Indeed, the success of Avatar: The Way of Water – which has already surpassed the $1 billion milestone at the global box office – demonstrates the continued demand for the big-screen movie-going experience. The release of other highly anticipated movies, such as Scream VI and John Wick: Chapter 4 could also drive increased traffic to its cinema doors.

In addition to the cash generated from ticket sales, the success of popular blockbuster movies can also have a “halo effect” on the overall movie-going audience. The buzz and excitement surrounding these films can lead to increased footfall at theaters, which could drive further sales of tickets for other films too.

Dave & Buster’s Entertainment

Mixing food and entertainment can be a powerful combination for businesses, offering would-be patrons a variety of experiences and activities all under one roof.

This can be especially attractive for groups looking for a fun night out, allowing them to enjoy the evening without journeying between multiple locations.

As one such outlet, Dave & Buster’s Entertainment has become a popular destination for people of all ages and backgrounds. The company’s restaurants provide a mix of arcade games in addition to a full menu of food and drink.

In fact, the firm has become so successful recently that it’s considering expanding its operations internationally. PLAY’s third-quarter revenue spiked 51.3% to $481.2 million, giving the business the latitude to seek out opportunities in other territories abroad.

To this end, the company has agreed with Abdul Mohsen Al Hokair Holding Group to establish the brand “across key West Asian” provinces. Indeed, with the development of key strategic initiatives, such as its ability to offer localization and demographically agnostic marketing programs, Dave & Buster’s is likely to see massive growth in the coming years.

The author has no position in any of the stocks mentioned. Financhill has a disclosure policy. This post may contain affiliate links or links from our sponsors.