In this article, we’ll take a look at five dividend-paying large-cap companies whose businesses are all extremely profitable.

And yet, while they share the ability to generate healthy earnings, each one also exhibits unique attributes that make them excellent additions to anyone’s stock portfolio.

So, without further ado, let’s jump right in.

Pfizer

It’s not unfair to say that Manhattan-headquartered pharmaceutical outfit Pfizer has made a lot of money out of the recent coronavirus pandemic.

The company recorded total revenues of $81.3 billion in 2021, while, twelve months later, it still expects to see sales of its Comirnaty vaccine hit $34 billion this year, too – despite the worst of the COVID crisis being more or less over.

One consequence of such robust financial performance has been that PFE is in a secure position to continually grow its dividend distribution. Indeed, Pfizer sports a 3-year compounded annual dividend growth rate of 5.46%, which is backed up by a very low payout ratio of 24.4%.

But what should be especially exciting for investors is the fact that PFE reported its biggest-ever quarterly revenue haul earlier this year. Couple this with year-on-year EBITDA growth of 66.3%, and the stock looks almost too good to resist.

However, if unparalleled sales figures – and a rapidly accelerating bottom line – cannot convince you to buy, Pfizer’s superior product pipeline should seal the deal. The biotech firm has a raft of promising drug candidates lined up that the firm’s CEO, Albert Bourla, has hailed as “potential blockbusters.”

Moreover, some medicines are already on the market and creating value for the company. One such offering, Paxlovid, has demonstrated efficacy in the treatment of long-COVID, which, if all goes well, could expand its therapeutic use case and bring in even more cash than it currently does.

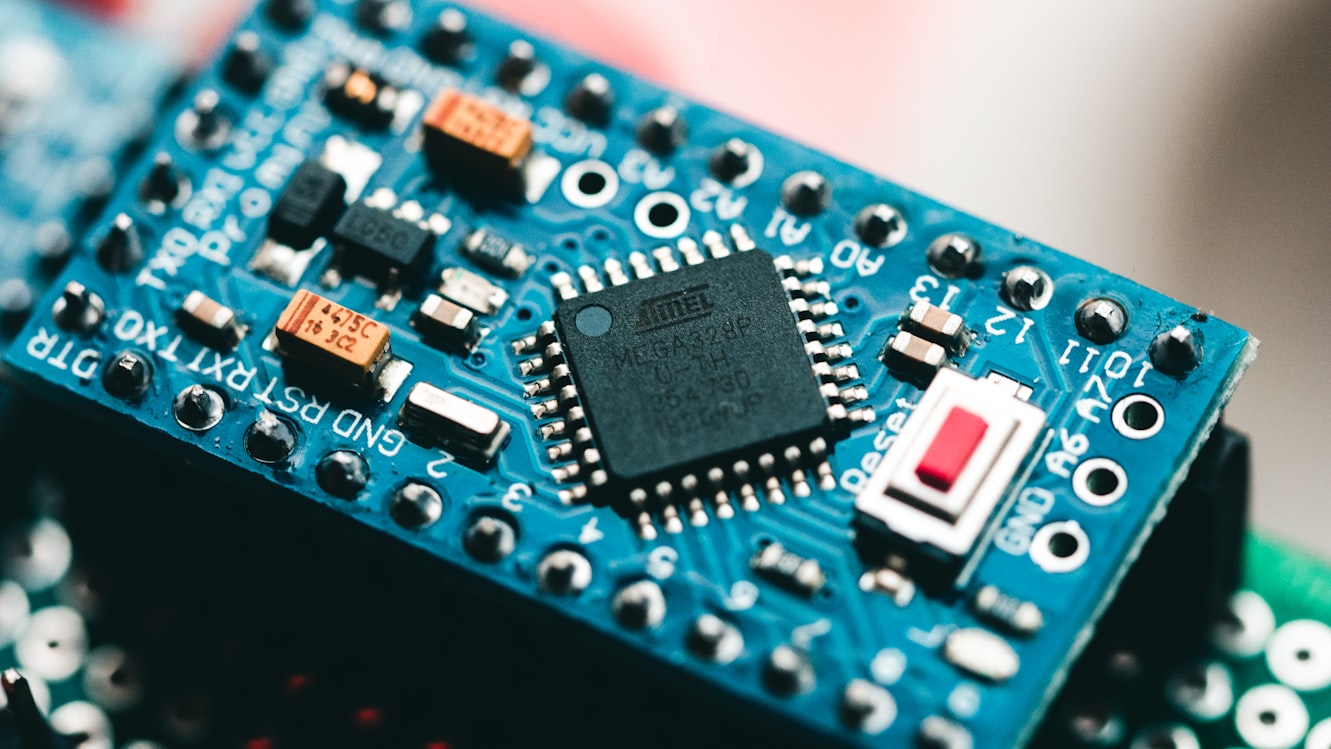

Source: Unsplash

Texas Instruments

Chip manufacturers have faced some pretty severe setbacks over the last few years. One of the most notable was the outbreak of the COVID-19 pandemic, which disrupted global supply chains and had a major impact on chip production.

Moreover, a global shortage of engineering talent is also expected to impact the semiconductor business, with industry insiders suggesting the problem “is becoming a more serious concern.”

However, the pandemic wasn’t the only thing that caused headaches for microchip manufacturers. There was also a clamor for integrated circuit technology as more companies began using it for new applications such as AI and 5G. This created a situation where there was a greater demand than supply, leading to higher prices and shortages.

Despite these challenges, chip makers have remained resilient and, having continued to invest in new technologies and foundries, are now starting to see a rebound in fortunes.

Indeed, Texas Instruments is capitalizing on the lull in manufacturing activity by positioning itself to pounce when the pullback recedes. For example, the company has a counter-cyclical capital investment scheme whereby it will increase production capacity to roughly $3.5 billion annually until 2025.

What’s more, while those plans play out, the firm still offers a dividend with a 5-year growth rate of 17.2% and a yield of 2.85%. It’s also reasonably safe, with a trailing twelve-month (TTM) interest coverage multiple of 52.8.

Merck

The Darmstadt-based science and technology multinational Merck has had a curious year. The firm’s share price has exploded 48.4% since January, despite the SPDR S&P Pharmaceuticals ETF – often considered a benchmark for the sector as a whole – falling 9.74%.

While this might seem strange, the broader Healthcare Sector is notorious for being a somewhat recession-proof industry. And, with the possibility of an economic downturn on the cards in 2023, it’s only natural that investors would flock to a safe-haven stock like MRK.

However, while the company will no doubt enjoy the positive price momentum while it lasts, the business has a conundrum on its hands. The firm’s high-profile wonderdrug, Keytruda, is approaching a so-called patent cliff, and Merck faces a loss of exclusivity on the medicine if it cannot gain a label expansion. Given that Keytruda accounted for $5.4 billion of its $15 billion revenues in the third quarter, that loss would be acutely felt.

That said, MRK’s 11 years of dividend growth looks secure with a payout ratio of 35.5%, while its 19.5% levered cash flow margin leaves it plenty of funds to fulfill its distribution obligations.

Verizon

With a forward-yielding dividend of 7.04%, telecommunications giant Verizon pays out the biggest distribution of any company on this list. And perhaps not surprisingly, the firm also has the largest payout ratio at 48.6%.

But don’t be deceived by VZ’s less-than-stellar dividend safety profile – the company still has a lot going for it as an income-generating stock.

For instance, as the purveyor of the fastest 5G Ultra Wideband anywhere in the world, Verizon can attract customers with its superior technological prowess. In fact, the firm made 377,000 new net additions to its broadband user count in the third quarter, with over 30 million households now covered by its 5G Ultra Wideband offering.

Home Depot

As inflationary headwinds continue to mount, businesses in the Consumer Discretionary sector are starting to feel the pinch. In fact, with shoppers tightening their budgets and disposable incomes shrinking, they’re also cutting back on non-essentials, including big-ticket items like home improvement projects.

Unfortunately for firms like Home Depot, this often means lower sales and increased pressure to keep costs down.

Indeed, the company has seen its revenue growth diminish to just 5.6% year-on-year, with comparable sales even less inspiring at 4.3%. However, net earnings were up 8.2% at $4.24 per diluted share, which was reflected in HD’s impressive net income margin of 10.9%.

Interestingly, despite losing 22.3% of its value in 2022, Home Depot’s TTM non-GAAP PE ratio remains stubbornly high at 19.3 – almost twice the industry median of 10.7.

So, if Home Depot’s revenues are stalling – and its shares aren’t cheap – what exactly does it have to offer potential investors?

Well, to begin with, HD has increased its dividend by an average of 16.38% over the last five years, meaning its actual cash payout has more than doubled in that time. In addition, the company can also boast a huge return on common equity of 1,466%, suggesting that the business has the funds to continue raising its distribution.

And while things may look a little bleak right now, that’s not necessarily how Home Depot’s chief financial officer, Richard McPhail, sees it. In fact, during the firm’s third-quarter earnings call, McPhail said that the business’s customers have “proven resilient,” even though the company is operating against a background of supply chain constraints and a monetary policy designed to curtail demand.

The author has no position in any of the stocks mentioned. Financhill has a disclosure policy. This post may contain affiliate links or links from our sponsors.