Exercise and Assignment

When a stock option is exercised, the call holder buys the stock, and the put holder sells stock. When options are exercised, the OCC decides to which brokerage firm, such as TastyWorks, the exercise will be assigned, and the brokerage in turn decides which customer will get the assignment.

When we are assigned an exercise and are required to sell our shares, the shares sold are said to have been called out or called away. Assignment occurs, then the shares are called out. Assignment on a short put means purchasing the stock.

Assignment is completely random, and an exercise can be assigned to and apportioned among several different call writers. Once assignment by OCC occurs, settlement between the buying and selling parties is automatic. Shares must be physically delivered once exercise occurs.

The covered call writer doesn’t have to do anything; the call writer’s broker handles settlement, delivers the shares and collects the exercise funds. Option exercise or assignment can be partial: one can exercise less than all the options held. Conversely, you may be assigned on less than all your short calls or puts.

However, one cannot exercise or be assigned on part of a single option contract. If you buy a call (put), you are not required to buy (sell) the underlying stock; you may sell the option to close or allow it to expire worthless.

Automatic Exercise

The OCC automatically exercises options that are $0.01 or more ITM, unless the option holder has notified his/her broker not to allow exercise of the option.

Note that a stock’s price can tick up or down after the close on expiration Friday, resulting in calls or puts (but not both calls and puts, obviously) that were near the money at Friday’s close becoming in the money – and being exercised.

If you are long calls on expiration Friday, you could find yourself purchasing shares unexpectedly, due to a late-day or after-market tick up in the stock.

Or if instead long the puts then, you might find yourself selling shares unexpectedly; and if you don’t own the underlying shares, this would either create a short stock position in your account, or your broker would buy you in (purchase the shares on your behalf) in order to cover itself.

Be sure your broker knows your wishes if you are long options at expiration and have not closed them. Writers of short calls and puts can similarly find themselves assigned an exercise due to the same mechanism.

Early Exercise

Because stock options are American-style, you can be assigned an exercise any time an option is in the money, although options typically are not exercised early while there is still time value remaining.

The reason is that the exercise of an option forfeits its time value; to capture the time value it is necessary to flip (sell) the option. But as expiration draws near, options that are in the money sometimes trade at parity, and this is when early exercise occurs.

Options trading below parity practically beg arbitrageurs to exercise them for risk-less profit. This subject is covered in more detail in the chapter on Portfolio Writing.

Where Stock Options Go:

60% – are traded out (sold or bought to close)

30% – expire worthless

10% – are exercised

Source: Chicago Board Options Exchange (CBOE)

Option traders like to say that only 10% of options are exercised, which is generally true, though not true in all cases. Thus if you write a call, the odds against assignment are roughly 9:1, statistically speaking.

But if a call is written ITM, the odds are quite high it will be exercised, despite the overall 9:1 odds. No matter where written originally, if the calls are in the money (ITM) $0.01 or more at expiration, exercise is a virtual certainty.

ATM and OTM options are never exercised, since it is cheaper to buy or sell the stock in the open market than to exercise an option.

Option Premiums

Premium

The premium is the price paid or received for an option. Options are traded much like stocks, with bid and asked prices shown:

- Seller generally receives the bid price

- Buyer generally pays the asked price

- The market maker or specialist keeps the spread between the bid and asked prices.

Example: A stock is trading at $30, and the July 30 Call prices are quoted as follows:

Bid = 1.65 Asked = 1.70

This means the high bidder will pay $1.65, and the lowest price offered to buyers is $1.70. Note the 0.05 spread between the two prices.

Actually, the only time the seller can be assured of getting the bid price, or the buyer paying only the asked price, is to enter the trade order as a market order, in which case they get the market price at the time the order is executed.

Market makers have to execute a market order at market price, up to the number of contracts for which the bid or offer is good, but are not obligated to take limit orders. By using a limit order, the seller might get 1.70 or even 1.75 for writing the call. And the buyer can enter a limit order for less than 1.70 (ex: 1.65), in an attempt to buy the call more cheaply.

Historically, the premium referred to the total amount received for selling the contract, not to the option price. However, today the term “premium” simply means the option’s price on a per-share basis. That is, if the premium shown is bid at $0.80, that means $0.80 per share; you would expect to receive $80.00 ($0.80 x 100) for an entire option contract relating to 100 shares when using a market order. As we are about to see, premium is not just premium. The premium can be all intrinsic value, all time value, or contain both.

Option Premium: Intrinsic and Time Value

Intrinsic value is the portion of the premium that is in the money. Intrinsic increases dollar-for-dollar with the stock price as it moves. Only ITM calls have intrinsic value.

Intrinsic value = total premium – time value

Time Value is the portion of the premium that is not in the money. It is also known as “extrinsic value”. Time value is the amount upon which return is calculated in covered call writing. ATM and OTM premium is all time value. Time value = premium – intrinsic value.

Time value = total premium – intrinsic value

Calculating intrinsic and time value is simple. First, calculate the intrinsic value part of the premium. The remainder is time value. The entire premium of an ATM and OTM call will always be 100% time value. The following examples illustrate how to determine intrinsic and time value. In both examples assume the stock price is $20.

Example 1: ITM 17.50 Call – premium is $3.50:

| Calculating Intrinsic Value | Calculating Time Value | |||

| XYZ Stock price | 20.00 | Total premium | 3.50 | |

| – Strike price | (17.50) | – Intrinsic value | ( 2.50) | |

| Intrinsic value | 2.50 | Time Value | 1.00 | |

Example 2: ATM 20 Call – premiums is $1.00:

| Calculating Intrinsic Value | Calculating Time Value | |||

| XYZ Stock price | 20.00 | Total premium | 1.00 | |

| – Strike price | (20.00) | – Intrinsic value | ( 0) | |

| Intrinsic value | – 0 – | Time Value | 1.00 | |

Somehow, financial writers manage to make it sound as though the intrinsic value is the “real” or valuable part of the premium. Not so for the option seller!

The profit in covered call return calculations lies solely in the time value. Suppose for example that when the stock is $32.50 you were to write the 30 Call for a $3.00 premium, which seems fat.

But if assigned at the $30 strike price, you must sell the stock for $30. Thus your return will be the time value amount, which was only $0.50 (3.00 – 2.50 intrinsic value). Think of the intrinsic value as your money; when selling the call, the intrinsic portion really is an advance payment of your money, since you could sell the stock and get the intrinsic amount immediately.

Note above in the intrinsic value definition that I said it increases dollar-for-dollar with the stock price. I am referring to the intrinsic value only. Suppose a stock is $30 and the current-month 30 Call can be sold for $1.25; obviously, the entire premium is time value since the call is not ITM.

If the stock moves up $1.00 to $31, the total premium may only increase $0.50 (to $1.75), not dollar-for-dollar with the stock. In this example, time value actually shrank from $1.25 to $0.75 with the stock’s rise. The 30 Call originally had $1.25 of time value, but the stock’s $1.00 price rise reduced the time value to $0.75 since the call is now $1.00 ITM.

Parity

Parity simply means that the option is trading precisely at intrinsic value and refers only to ITM options, since only they have intrinsic value. Options seldom trade more than a few pennies below parity (sub-parity). ITM options tend to trade at parity when:

- Expiration draws near and there is little time value left, or

- There is no expected volatility in the underlying stock.

Characteristics of the Three Call Strikes

ATM calls (at-the-money calls), which are all time value, offer the most time value premium and the largest returns. They also provide a reasonable degree of downside protection should the stock price drop. ATM options usually are the most heavily traded because they are worth more to the market. Why? The trader is not paying for intrinsic value.

OTM calls (out-of-the-money calls), which also are all time value, offer less time value premium than ATM calls and provide the least downside protection. OTM time value premium usually is higher than for ITM calls, at least in flat or rising markets.

ITM calls (in-the-money calls) usually offer the least time value premium, especially in a rising market, but the biggest downside protection. On a falling stock, though, their time value premium can be comparable to or better than for OTM calls.

Throughout these articles, we will be referring to options as ITM, ATM or OTM. The easiest way to keep them straight is to learn them for call options. Then remember that ITM and OTM are the opposite for put options.

Time Decay

Time decay means that the time value portion of the option premium will shrink as time runs out. The intrinsic value portion of ITM calls never shrinks due to passage of time.

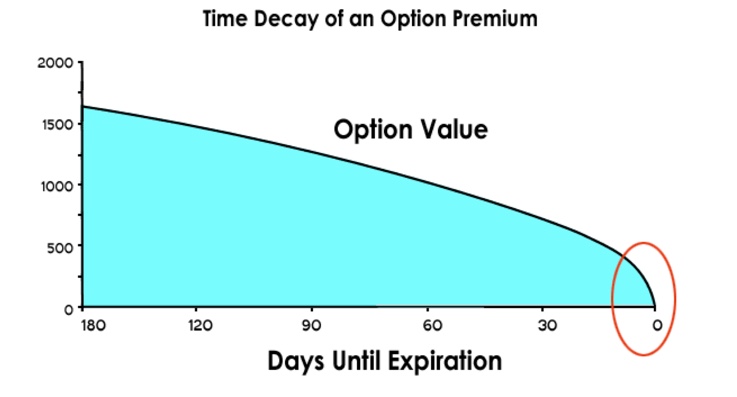

Time decay accelerates in the last 30 days of an option’s life, and the most rapid time decay occurs in the last 10 days. Time decay is one of the two reasons for writing calls in the current expiration month. (The other is premium compression, which means that the more time you sell, the less premium you receive per month sold.)

Stock does not expire and thus its price is not affected by the passage of time. The fact that options expire by their own terms means that they lose value at a steady rate (until the last 30 days, at any rate) – the time decay. Effects of time decay:

- Time – time is on the side of the call writer, not the call buyer, because time locks in the call writer’s profit. That is, when the call expires worthless, the call writer keeps all net premium received. On the other hand, time eventually destroys the option and thus the call buyer’s entire investment.

- The Ex-Monday Drop – time decay also explains why the premium for an option drops on the Monday following expiration, when the near-month option becomes the front month.

The following graph illustrates how an option loses value (decays) with the passage of time. Note the acceleration of time decay in the last 30 days and the very rapid acceleration in the last 10 days. Of course, it is the time value portion of option premium that decays; intrinsic value never decays.

Figure 2.6

The time remaining in days to expiration is an important time factor. In legal terminology, an option is a wasting asset (it expires naturally with time), and as the option’s expiration date gets closer, the value of the option decreases.

The more time remaining until expiration, generally the more time value the option contract has. If the underlying asset price falls far below or far above the strike price of the option, the price of underlying asset in relation to the strike price becomes more significant in determining the option’s price.

On the day the option expires, the only value the option contract has is its intrinsic value, if any (ITM options).

Theta is the expected change in an option premium for a single day’s passage of time. That is, if all other factors are not changed, then option premium should be lower the next trading day by the theta value. Theta, then, expresses time decay of an option’s time value.

>> More: Introduction To Options

The author has no position in any of the stocks mentioned. Financhill has a disclosure policy. This post may contain affiliate links or links from our sponsors.