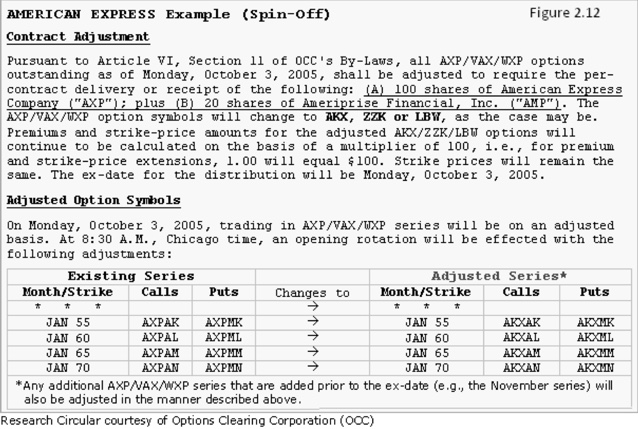

Following is a 2005 research circular relating to the American Express (AXP) spin-off of Ameriprise (AMP) shares, abridged for illustration purposes. The circular specifies the changes in option symbols and deliverables and states that the multiplier and strikes will not change.

Keep an Eye Peeled for Adjusted Options

Option chains and data feeds may or may not include non-standard options, which is why many scanning systems inadvertently include them. While some of these events are handled in predictable fashion, there are oddball situations or tweaks to common events that can result in adjustments slightly different than noted above. The research circular is the final authority.

When adjustment is required, all regular and LEAPS options already in existence on the date the event is announced will be adjusted. Only options that come into existence following the event’s effective date will be standard options with standard OPRA price symbols. The covered writer, as a shareholder, should receive notice of such events, but the better practice is to keep an eye peeled for these options, since it is better to avoid them if the adjustment has been announced. Both the CBOE and OCC websites explain contract adjustments.

It can be difficult to tell if adjusted options are well-priced or to calculate returns. Fractional shares always are settled in cash. Spreads are wider on adjusted options, liquidity usually is poor (if they still are even traded) and few brokers understand them. Once the odd delivery requirements are taken into account, the option may not be profitable. The wiser practice is to avoid non-standard options entirely.

Your broker’s online platform should identify non-standard options. It certainly should not allow you to put on a trade involving a non-standard option without notifying you of the fact. If your broker fails either of these simple tests, switch brokers.

TRADING TIP: An abnormally high return is a tip-off that an option is non-standard. But when the adjusted terms are taken into account, the returns may be low or (practically) incalculable. Odd strike prices (ex: 33.25) and a different root symbol than other listed options available both potentially signal adjusted options.

The author has no position in any of the stocks mentioned. Financhill has a disclosure policy. This post may contain affiliate links or links from our sponsors.