Although the stock market has defied gravity for longer than most bears can tolerate, some healthcare stocks are entering a period of seasonal weakness.

Acorda Therapeutics [ACOR]

Acorda Therapeutics is not a familiar name to most traders but it is flashing warning signs that a compelling short stock or bearish play is on the horizon.

The company develops and sells therapies for neurological disorders, markets drugs for multiple sclerosis, as well as pills to manage spasticity and dermal patches to manage post-herpetic neuralgia.

Acorda has a wide range of other biopharmaceuticals under development for Parkinsons disease-related dementia, conducts research on treatments for spinal cord injuries and much more.

So, at first glance, it is not obvious why a strong seasonal trend should emerge as might be expected of a stock like H&R Block [HRB], which has a natural seasonal tendency surrounding the timing of tax filing.

But a strong seasonal pattern has certainly emerged over the past decade. While the stock is choppy at the best times, it has fallen lower in 10 of the last 11 years over the next 7 weeks by an average 10.2%.

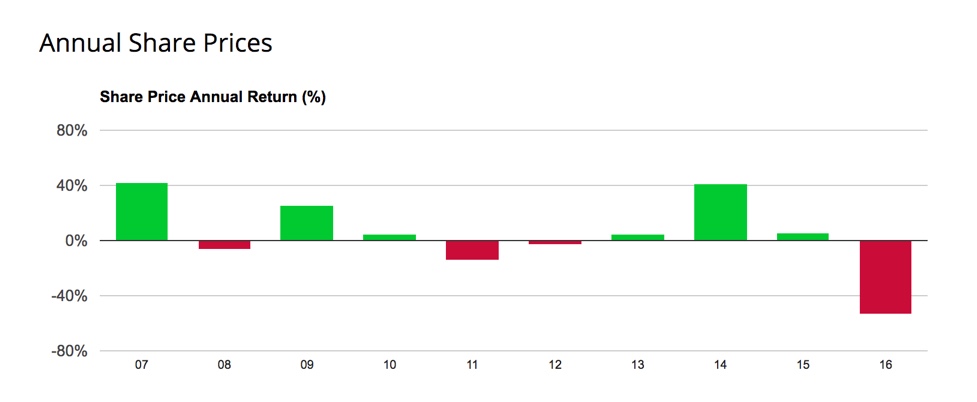

Annually, the share price has trended positively, and you can see more often than not the share price has ended up in the green over any calendar year, but summer doldrums seem to take their toll on Acorda more often than not.

Omeros Corporation [OMER]

Another biotechnology company in the healthcare sector displaying seasonal weakness is Omeros Corporation.

Omeros specializes in developing protein therapeutics for disorders or the central nervous system. It also markets OMIDRIA which is used during cataract surgery as an intraocular lens replacement. And Omeros has a host of clinical programs targeting Huntington’s diseases and schizophrenia, opioid and nicotine addiction, as well as urological procedures.

Plus, Omeros has drugs in clinical trials targeting other addiction and compulsive disorders in addition to traumatic bleeding. Orthopedic surgeons will be intrigued to see whether Omeros succeeds in clinical trials designed to reconstruct anterior cruciate ligaments and conduct arthroscopic partial meniscectomy.

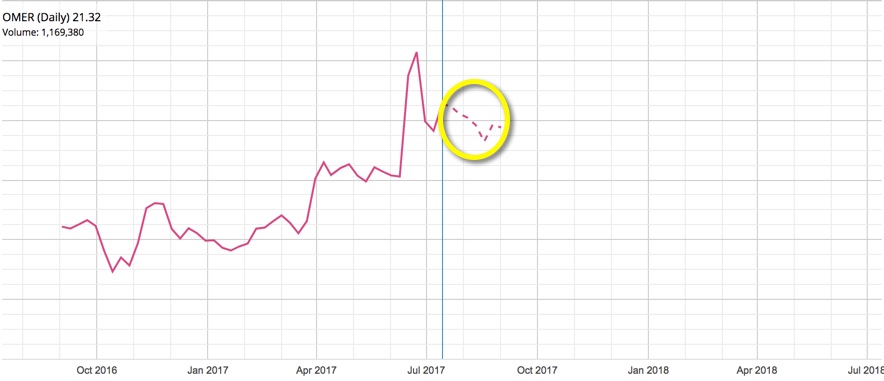

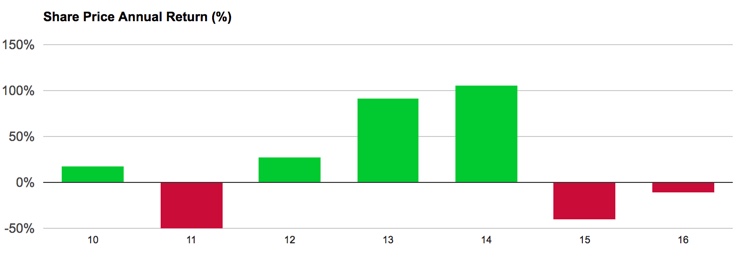

When it comes to its share price, Omeros has on average fallen by 9.0% over the next 7 weeks. In 6 of the prior 7 years the stock has declined during the July through August period.

Over the past few years, the stock hasn’t rallied along with the market, which is to be expected for a pharma stock that is heavily dependent on the success of clinical trials, more so than the general trend of the S&P 500. 2015 and 2016 were tough years but the stock has rallied back in 2017.

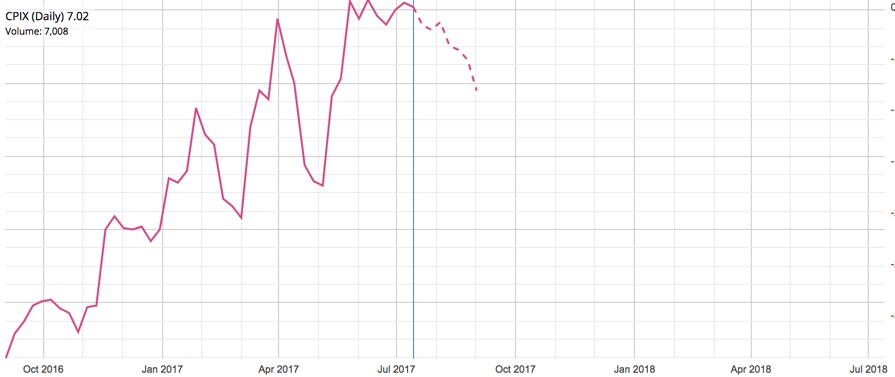

Cumberland Pharmaceuticals [CPIX]

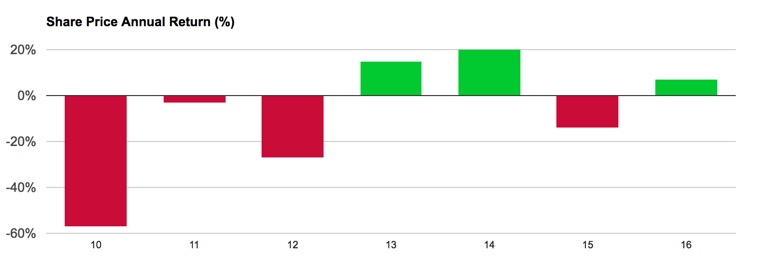

The one constant among pharmaceutical stocks is volatility and Cumberland share price is no exception to the rule. Looking at its past share prices over recent years, you can see occasions when it plunged and soared.

It is no surprise that Cumberland has seen its fair share of ups and downs. As a specialty pharmaceutical company, it lives and dies by the success of its products, which include:

- Prescription products for hospital acute care and gastroenterology markets

- Acetadote which treats acetaminophen poisoning

- Kristalose, a prescription laxative

- Treatments for H. Pylori infection and duodenal ulcer disease

- Oncology treatments

- Injections for rheumatoid, psoriatic and juvenile idiopathic arthritis

Looking to its seasonal share price trends, Cumberland has historically struggled over the summer months with an average 8.1% decline in 6 of the past 7 years.

To capitalize on share price declines of higher priced stocks, buying put options is a reasonable strategy but a low priced stock like Cumberland can be shorted with comparatively low capital requirements too.

To limit risk when shorting stock, you can look to buy calls against the short stock as a hedge. For pharmaceutical stocks that are infamous for volatility, both to the upside and the downside, the cost of a call relative to the risk incurred from a sharp spike higher is low.

It only takes a single announcement from the FDA to cause a share price to spike higher or plummet lower. Unlike most stocks, which generally undergo more predictable periods of volatility during earnings seasons, pharmaceuticals can catch you by surprise when you’re least expecting it.

The surprise element of share price fluctuation means that no matter how certain you are of a trend, even if the seasonal trend has been compelling for years and the stock chart looks bearish, it is imperative you don’t put all your eggs in one basket.

Spread risk appropriately among different stocks and even asset classes. As they old adage goes, there is no free lunch in the stock market but diversification may be as close as you get to one.

> READ: What Billionaires Understand About Compounding

The author has no position in any of the stocks mentioned. Financhill has a disclosure policy. This post may contain affiliate links or links from our sponsors.