Puts and calls can be naked or covered, and their deployment depends on the trader’s strategy and expectations for the underlying stock. The following section “covers” the primary rationales for buying or writing puts or calls.

Call Options (Calls)

Call options sold are considered “covered” when the writer owns a number of the underlying shares equal to the number of contracts written times 100 (for standard options), because the obligation to deliver the shares if assigned is covered. Thus it is the delivery obligation that is covered.

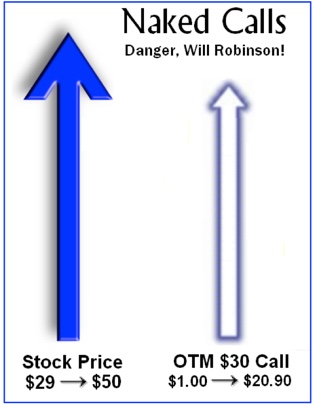

Calls are “naked” (“uncovered”) when the writer does not own the underlying shares. The risk in a naked call position is that the stock price advances, forcing the writer to buy the stock at market at a price higher (perhaps much higher) than at trade entry. The risk from naked call writing is, at least theoretically, unlimited, because the stock has no limit theoretically to how high it could rise.

Figure 2.7

When the stock is $29, you write the current-month $30 Call for a $1.00 premium, expecting the stock to sell off. The call is naked (uncovered) because you do not own the stock. This looks like $1.00 in free premium, doesn’t it?

But news on the stock sends it to $50. You have a real problem. The $30 Call was out of the money when you wrote it, but is now $20 in the money. It will of course be exercised, requiring you to deliver the stock at the $30 strike price.

The problem is that you don’t own it. You’ll have to go into the market and buy the stock for $50 (or more), just so you can sell it for $30. How did you do on the trade?

– $50.00 Bought the stock

+ 30.00 Sold the stock

+ 1.00 Premium realized

– $19.00 Loss

That’s a loss of $19 per share, or $1,900 per call contract. That’s quite a hickey, as brokers say.

You could wait (hope) for a pullback in the stock in order to buy it cheaper than $50 or buy back the call at a lower price, but that is a risky proposal, since the stock might continue up. Your brokerage firm will not be so sanguine about the situation and how you handle it, since it (or its clearing firm) must make the trade good by delivering the underlying shares upon assignment if you cannot.

For this reason, naked call writing usually is restricted to traders with real experience and minimum net account equity of $100,000 or more.

Put Options (Puts)

Puts are considered “covered” when the writer has a short position in the underlying stock. The combination of short stock and short put creates a position that is the synthetic equivalent of, and presents the same risk/reward profile as a naked call. If your broker will not allow you to write naked calls, you will not be allowed to place a covered put trade, either. Note that a long stock position does not cover a short put, since assignment on a short put requires you to buy, not deliver, the stock.

A naked put is one not covered by short stock. Many, including some brokers, consider naked puts unduly risky, but as explained in the Naked Puts section below, the covered call is just a synthetic way of creating a naked put position. The positions present an identical risk/reward profile. The maximum possible risk is that the stock goes to zero. The trader risks the stock price less the premium received (covered call) or the put strike less the premium received (naked put). Thus if your broker allows you to write covered calls, it should also allow you to write naked puts, including in an IRA account, though even if permitted, the broker may require a higher level of options approval to transact naked puts in an IRA or 401(k) account, which can be managed automatically by a company like Blooom, which specializes in digital automated management of 401(k)s.

As will be discussed in more detail below, another use for naked puts is to purchase stock at a discount. Smart investors looking to acquire a particular stock for a portfolio will often sell puts on the shares, hoping the shares will be “put to them, the purchase price being reduced by the amount of the premium received. This is a technique far more investors should use to buy stock at a “discount.”

Naked puts can be written repeatedly until the stock is acquired due to exercise of the put. It can take a while, though. I have sold naked puts for months and never acquired the stock!

Example: When XYZ shares are $22, an investor might sell the current-month 20P for a $1.00 premium, hoping the shares are put to him. If the shares are below $20 at expiration the put will be exercised, and the investor would in that case buy the shares at the $20 put strike. But the $1.00 premium received reduces the cost to $19: far better than having bought it at $22. Sure, the stock had dropped below $20 temporarily, but the investor wanted the stock. Had the stock not been put to him, the $1.00 premium would have been pure profit.

>> How Does Options Exercise & Assignment

#1 Stock For The Next 7 Days

When Financhill publishes its #1 stock, listen up. After all, the #1 stock is the cream of the crop, even when markets crash.

Financhill just revealed its top stock for investors right now... so there's no better time to claim your slice of the pie.

See The #1 Stock Now >>The author has no position in any of the stocks mentioned. Financhill has a disclosure policy. This post may contain affiliate links or links from our sponsors.